Mulina Swanson

New Member

- Jurisdiction

- California

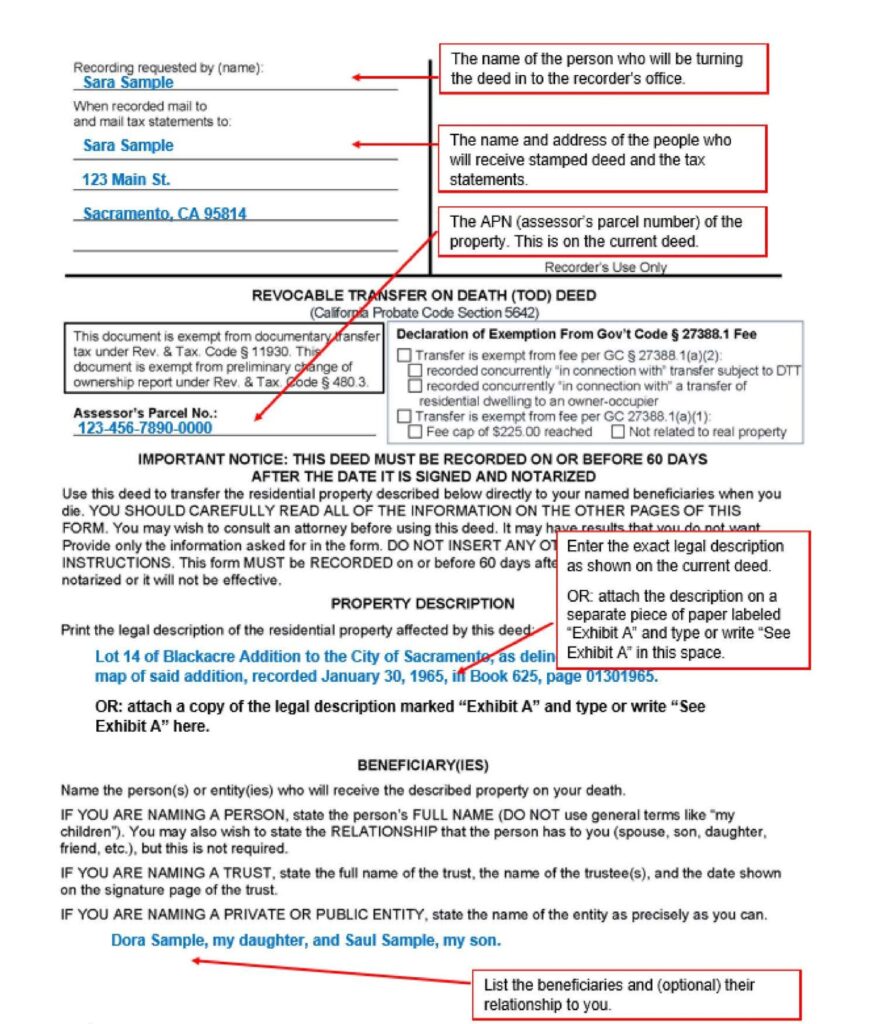

Many years back I had an attorney create a trust and a will for me. I no longer want my assets to go to the beneficiary of my current will. I'm in CA. I am going through a lot in these next couple years and do not have time to visit an attorney to revamp the will, but having it unchanged in the meantime makes me uneasy. Can I handwrite a new will, and leave it somewhere in my home where it is likely to be found?

A related question: Is there any way to have a will's beneficiaries refer to a Schedule or something of the sort, so that in the future I can change beneficiaries without the time and expense of going through a lawyer?

A related question: Is there any way to have a will's beneficiaries refer to a Schedule or something of the sort, so that in the future I can change beneficiaries without the time and expense of going through a lawyer?