Missouri offers a probate shortcut for "small estates." This makes it easier for survivors to transfer property left by a person who has died. You may be able to transfer a large amount of property using the following probate shortcut -- saving time, money, and hassle.

Missouri has a simplified probate process for small estates. To use it, an inheritor or the personal representative files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

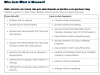

You can use the simplified small estate process in Missouri if the value of the entire estate, less liens and encumbrances, is $40,000 or less. There is a 30-day waiting period. You will have to get a bond (an insurance policy that protects the estate) in an amount equal to the value of personal property. You are responsible for ensuring debts owed to the state of Missouri and the estate will pay funeral and burial expenses before you receive your inheritance. You are also responsible for giving the other inheritors the assets they are entitled to.

Your written request must include the following information:

a statement that there is no will or the will was presented for probate within one year of the person's death if no notice was published

a statement that all unpaid debts, taxes, and claims against the deceased person on the property transfers requested in the affidavit have been paid or will be paid

an inventory and valuation of the deceased person's property

the names and addresses of people or businesses who have the property, and

the names, addresses, and relationship of people entitled to the assets and who will receive the property after paying the deceased person's claims and debts,

If the value of the personal property is more than $15,000, the court clerk must publish a notice in a local newspaper that tells creditors to file their claims within one year from the date of publication. Mo. Rev. Stat. § 473.097

473.097 .

Probate Administration for Small Estates in Missouri

A normal probate administration in Missouri involves over $40,000 in net assets, so an estate with less than $40,000 is referred to as a "small estate."

Why does the law set special rules for small estates? Think about it, if our court system had to conduct a full, year-long administration for every small estate, the costs of administration might often exceed the amount of trust assets. At the very least, the costs would make the probate process cost-prohibitive. In addition, if the court system put the same amount of time and effort into small estates as regular estates, the system would be jam-packed. Cases would take even longer than they do now.

Probate Law for Small Estates

So estates worth less than $40,000 actually go through the probate process differently. Special procedures and rules exist for small estates in Missouri, allowing these estates to be dealt with in a simpler and more efficient manner. The typical small estate will take about 4 to 8 weeks to complete, as opposed to the 8 to 12 months that a regular probate administration would take.

Usually, a person who has a legal interest in the property of the decedent (called the "affiant") is a family member and legal heir under the probate laws of the state of Missouri or a beneficiary named in the deceased party's will. The affiant petitions the court to probate the small estate, and the probate court will eventually issue an order to not commence a full estate probate. Instead, a small estate claim will commence and grant the affiant authority to gather and distribute the small estate's assets.

Small estates that have over $15,000 in assets require notice to be published in the paper, while estates with less than $15,000 require no such notice. Additionally, a small estate affidavit can be filed with a Missouri probate court at any time, even more than one year after the date of death.

Missouri Probate Law on Small Estates Affidavit

Good luck, and please accept my sincere condolences upon the loss of your beloved mother.

May you grieve and mourn her passing and receive peace in knowing that she resides in her mansion prepared by her Savior, our Lord. May His mercy and grace make your time of bereavement swift, as her memory will live forever in your heart.