- Jurisdiction

- Nevada

Long story, but I need some assistance figuring this out. Hopefully we have guys in here that are familiar with this industry.

6 months ago, I decided to see a hand doctor about my hand. I think it's carpal tunnel syndrome. It's been bugging me at work since I work maintenance, I turn a lot of screws and bolts. I've had this pain for a long time now. The doctor says that since I've had it for around 20 years, he recommends doing surgery. The doctor is In-Network. I saw a neurologist to do some testing and then the time came for surgery.

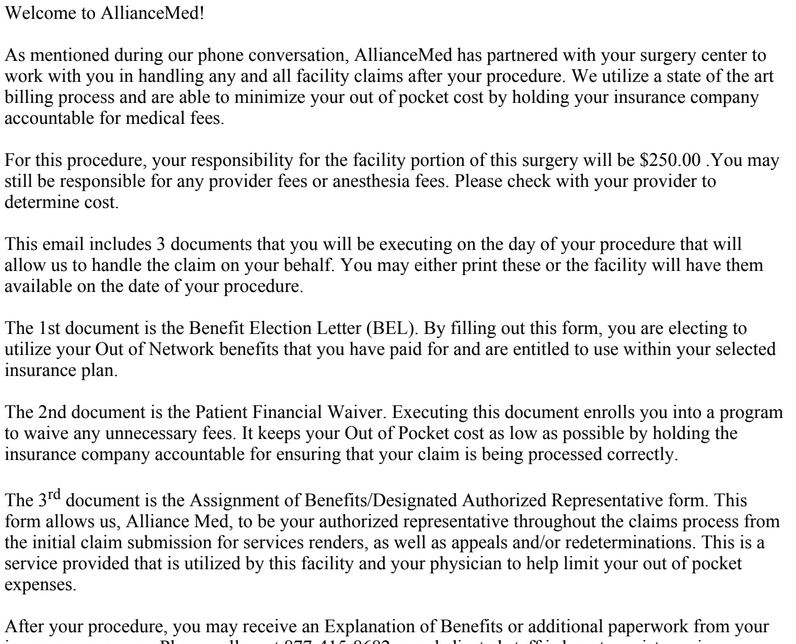

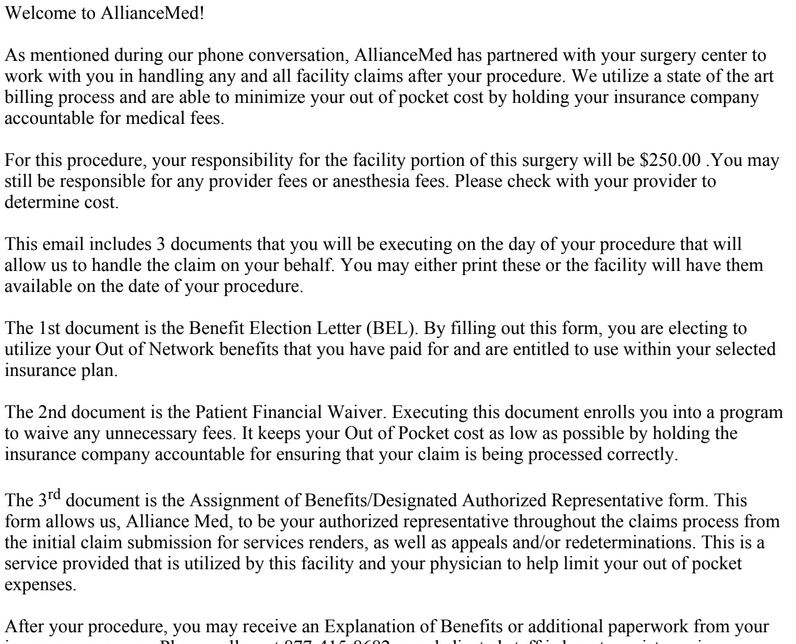

The surgery center is out of network, which is 50/50. I was going to back out, but the surgery center called me and the lady said I only pay $250 out of pocket. She reiterated this fact and I am now looking through my email to find the document.

Months after the surgery, I received a letter from my health insurance company denying the claim for the procedure because it hasn't been an effective way of treatment for carpal tunnel syndrome. They sent me this well after I've already had the surgery done. I thought the doctor would be in contact with the health insurance to make sure that the procedure is going to be paid by them, at least mostly. I forgot about the letter, this happened during the pandemic when a lot of shit was happening.

Fast forward to today, and I received a letter from the insurance company about an "appeal." I had no idea what it was about, so I called them up. The lady said it was about the surgery and the total was 40k, and I have to pay 38k out of pocket.

I haven't received any bills from the surgery center, so I don't know what's going on. I guess they were going back and forth with the insurance company trying to get them to pay.

I don't want to pay the $38k. The insurance I guess doesn't wanna pay, even though on the policy it says my maximum annual out of pocket is $8k.

This is complicated and Google is no help. I'm going to try calling the insurance company again and talk to a different lady. The one I talked to was no help and sounded like she just wanted to end the conversation ASAP.

Found the email about the 250. This is one of the pages out of 5

6 months ago, I decided to see a hand doctor about my hand. I think it's carpal tunnel syndrome. It's been bugging me at work since I work maintenance, I turn a lot of screws and bolts. I've had this pain for a long time now. The doctor says that since I've had it for around 20 years, he recommends doing surgery. The doctor is In-Network. I saw a neurologist to do some testing and then the time came for surgery.

The surgery center is out of network, which is 50/50. I was going to back out, but the surgery center called me and the lady said I only pay $250 out of pocket. She reiterated this fact and I am now looking through my email to find the document.

Months after the surgery, I received a letter from my health insurance company denying the claim for the procedure because it hasn't been an effective way of treatment for carpal tunnel syndrome. They sent me this well after I've already had the surgery done. I thought the doctor would be in contact with the health insurance to make sure that the procedure is going to be paid by them, at least mostly. I forgot about the letter, this happened during the pandemic when a lot of shit was happening.

Fast forward to today, and I received a letter from the insurance company about an "appeal." I had no idea what it was about, so I called them up. The lady said it was about the surgery and the total was 40k, and I have to pay 38k out of pocket.

I haven't received any bills from the surgery center, so I don't know what's going on. I guess they were going back and forth with the insurance company trying to get them to pay.

I don't want to pay the $38k. The insurance I guess doesn't wanna pay, even though on the policy it says my maximum annual out of pocket is $8k.

This is complicated and Google is no help. I'm going to try calling the insurance company again and talk to a different lady. The one I talked to was no help and sounded like she just wanted to end the conversation ASAP.

Found the email about the 250. This is one of the pages out of 5